I think both those concerns as well as one not mentioned (home made EVSE's and Home made power) could be addressed not by "metering" the evse but the onboard charger itself. Yes it would require a change (may just software) and could be on newer EV's and may be even retro fitted to older. I addressed the phase in on a previous post.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

REALLY!!! $200 gas tax.

- Thread starter Spatterson61

- Start date

Help Support My Nissan Leaf Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

- Joined

- Jan 20, 2024

- Messages

- 35

Actually that's a really good idea. Very easy to implement. Can accumulate like a odometer, so it's not resettable. But how is it much different than a milage tax? It would reward frugal driving.

MikeinPA

Well-known member

A per mile fee would be highly understandable for the driver. They would see how much they are driving and if motivated could reduce their expenses by shifting driving habits.Actually that's a really good idea. Very easy to implement. Can accumulate like a odometer, so it's not resettable. But how is it much different than a milage tax? It would reward frugal driving.

On the other hand, a tax that is some percentage of fuel going into the car is difficult to relate to actual miles or costs. When it comes to fueling up a vehicle, its load, pay and go--you're at the pump and you just do it because you need to get somewhere.. The knowledge of what the tax is, where it goes, how much it costs you is just not there and therefore there is no incentive to change driving habits.

Now you are suggesting the tax be assessed not for road repair but to change driving habits, not the stated purpose of the tax.A per mile fee would be highly understandable for the driver. They would see how much they are driving and if motivated could reduce their expenses by shifting driving habits.

On the other hand, a tax that is some percentage of fuel going into the car is difficult to relate to actual miles or costs. When it comes to fueling up a vehicle, its load, pay and go--you're at the pump and you just do it because you need to get somewhere.. The knowledge of what the tax is, where it goes, how much it costs you is just not there and therefore there is no incentive to change driving habits.

I know if I fill my tank with gas three times a week it cost me money. I think people are smart enough to figure out if they charge their car three times a week it will cost them.

Cost of operation is always a factor, but I don't want to be manipulated at the whims of bureaucrats by time of day or location.

It would be shown on a monthly electric bill, fairly simple to read if you care too, far more so than getting hit with a years worth of mileage tax at renewal time.

MikeinPA

Well-known member

No, I am saying that a per mile fee would be more transparent to the tax payer, and more fair to all users. Who can be against that?Now you are suggesting the tax be assessed not for road repair but to change driving habits, not the stated purpose of the tax.

Again, for around a century, the fuel tax has been transparent. I don't see how a mileage tax which you have stated would have to reflect the size and weight, so would be different for differing vehicles is more transparent? Add to that it is not collect or billed in small amounts is preferable. Fuel tax where the tax is billed at purchase, (monthly for most electrical customers) handles that easily.

One thing that hasn't been said. Any change from a fuel based tax is going to require a change for EVERY vehicle. We will have ICE vehicles on the road for the foreseeable future. A mileage tax requires a tamper proof measure device, something most ICE vehicles have only recently had. My 1942 pays its fuel tax even without a working odometer.

A KWh tax would require no change for the majority of the vehicles in use today. As electrics gain market share they could be "brought into the fold" with a Kwh tax. So a Kwh tax would be easy to change too. The less the 2% of cars on the road today that are electric can be assessed a flat tax as they are now until retired or retro-fitted to supply the needed info to the power provider.

It is a proven system of collecting taxes, its weak point is the unwillingness to raise the tax to cover inflation and the dipping into the funds collected for other non road uses, something that any tax is subject too also.

The thinking that we must tear down the system and replace it, doesn't make sense if you are doing so for the stated reason of maintaining roads. I have not heard of any proposal that would not fall victim to the same "failure" that their proponents claim they are trying to remedy by abandoning the fuel tax.

A mileage tax alone isn't as fair as a fuel tax. It has to account for weight to do so is more complicated. Fuel, be it fossil or electric automatically charges larger and heavier vehicle more.

By moving tax collection to the power companies, you don't have every owner having to file a report and pay as a separate operation. Something the framers of the fuel tax reasoned when they collected the fuel tax at the point of retail sale. Far fewer actors to look after. Nothing is perfect, and their have been retail sellers prosecuted for not reporting and submitting the tax, but they were caught, something much easier to slip thought the cracks if it becomes each individual.

One thing that hasn't been said. Any change from a fuel based tax is going to require a change for EVERY vehicle. We will have ICE vehicles on the road for the foreseeable future. A mileage tax requires a tamper proof measure device, something most ICE vehicles have only recently had. My 1942 pays its fuel tax even without a working odometer.

A KWh tax would require no change for the majority of the vehicles in use today. As electrics gain market share they could be "brought into the fold" with a Kwh tax. So a Kwh tax would be easy to change too. The less the 2% of cars on the road today that are electric can be assessed a flat tax as they are now until retired or retro-fitted to supply the needed info to the power provider.

It is a proven system of collecting taxes, its weak point is the unwillingness to raise the tax to cover inflation and the dipping into the funds collected for other non road uses, something that any tax is subject too also.

The thinking that we must tear down the system and replace it, doesn't make sense if you are doing so for the stated reason of maintaining roads. I have not heard of any proposal that would not fall victim to the same "failure" that their proponents claim they are trying to remedy by abandoning the fuel tax.

A mileage tax alone isn't as fair as a fuel tax. It has to account for weight to do so is more complicated. Fuel, be it fossil or electric automatically charges larger and heavier vehicle more.

By moving tax collection to the power companies, you don't have every owner having to file a report and pay as a separate operation. Something the framers of the fuel tax reasoned when they collected the fuel tax at the point of retail sale. Far fewer actors to look after. Nothing is perfect, and their have been retail sellers prosecuted for not reporting and submitting the tax, but they were caught, something much easier to slip thought the cracks if it becomes each individual.

MikeinPA

Well-known member

Well, if we want to do history, the maintenance of roads is one of the earliest types of local government, far earlier than the War of Independence, "taxation without representation" and our Constitution. This made sense, because the roads were an essential public property, and people were willing to delegate authority to a newly formed council to take care of this public property. This worked fine for centuries. However, this changed dramatically with the advent of fossil fueled vehicles. So about a hundred years ago, roads are no longer just essential public property, they are also the main profit center for the rapidly growing fossil fuel industry. Today, we have a national highway system and ever expanding system of lesser roads that have been heavily influenced by this industry--and this certainly includes the distribution, pricing and taxing of the distillates in use. There are a huge number of studies that have looked at how this industry has shaped the roads and vehicles we have today over the past 100 years--and not in a flatteringly way. Two articles here: https://www.vox.com/2015/4/29/8513699/future-of-commuting

So yes, if we are trying to figure out how to fairly apportion the wear-related maintenance costs, and also the non-wear-related costs, the ongoing phase out of CO2 polluting vehicles is a great time to do this.

So yes, if we are trying to figure out how to fairly apportion the wear-related maintenance costs, and also the non-wear-related costs, the ongoing phase out of CO2 polluting vehicles is a great time to do this.

Last edited:

But none of the proposals do anything to address the weakness in the current system, all they do is create a new system with the same weaknesses.

ICE vehicles are going to go away, I agree, but the need to maintain the roads remains, and taxing those that use them seams the fairest. I am not against taxing, I am against invasive methods that have nothing to do with the use of roads, make it hard on the poor and open far more opportunity for abuse.

May be we need to double the tax on all fuels, liquid and electric, to meet the need, but changing how you assess the tax does nothing to address the issue of how much is assessed. The assessment rate is the issue if it is not meeting the need.

ICE vehicle ARE going to be here for the foreseeable future, even if all "NEW" sales are EV in 2035 (a goal I don't think is achievable) liquid fuel vehicles are going to be in widespread use for many more decades after that point.

ICE vehicles are going to go away, I agree, but the need to maintain the roads remains, and taxing those that use them seams the fairest. I am not against taxing, I am against invasive methods that have nothing to do with the use of roads, make it hard on the poor and open far more opportunity for abuse.

May be we need to double the tax on all fuels, liquid and electric, to meet the need, but changing how you assess the tax does nothing to address the issue of how much is assessed. The assessment rate is the issue if it is not meeting the need.

ICE vehicle ARE going to be here for the foreseeable future, even if all "NEW" sales are EV in 2035 (a goal I don't think is achievable) liquid fuel vehicles are going to be in widespread use for many more decades after that point.

MikeinPA

Well-known member

But ICE are just a small fraction vehicle miles in 26 years if we are making even a half-assed attempt at sticking to the 1.5 deg C guardrail. Many sources for that--one from the IEA below. I completely believe the need for a much faster phaseout will become evident to everyone in just a few years. We really need to rethink transportation for the next 100 years--including having the taxpayer having a greater say in what that looks like . ICE had it's day, and it's say, time to move on.

https://www.iea.org/reports/road-transport

https://www.iea.org/reports/road-transport

Last edited:

We don't disagree on that point. But that has nothing to do with road taxes and how they are assessed. All users should be taxed for their upkeep, I think that is another point we can agree on.

I am of the view that retiring something (junking) before it's useful life is up is the worse form of pollution, unnecessary.

Many can't afford to move to the latest and greatest, until I bought my 2015 Leaf, my newest was a 2000 MY. The only reason I could become a "cleaner" user of the roads is because the Leaf was cheaper than any other vehicle of its age.

I'd love to see a better passenger rail system, intra-continant travel by air is very wasteful. Again, open to change.

I am not against change, but question when a change in method of tax assessment is made that doesn't address the stated reason for the change and opens taxing for other reason. I abhor a slight of hand from those elected to serve our collective needs.

Even with electric's we are not going to meet the global temp goals. I live in a state that has gone "all in" on renewables but still we use fossil fuel for a portion of our electric power. Going to a mileage tax will not change that fact. Neither will mandates that can't be met.

I all the proposals for a "new form of road tax" the proposals all point to the present tax is not meeting the need. They don't show how their new form will not be subject to the same problem, that is the lack of will to tax at a rate that will meet the need. SO, I question why?

I am of the view that retiring something (junking) before it's useful life is up is the worse form of pollution, unnecessary.

Many can't afford to move to the latest and greatest, until I bought my 2015 Leaf, my newest was a 2000 MY. The only reason I could become a "cleaner" user of the roads is because the Leaf was cheaper than any other vehicle of its age.

I'd love to see a better passenger rail system, intra-continant travel by air is very wasteful. Again, open to change.

I am not against change, but question when a change in method of tax assessment is made that doesn't address the stated reason for the change and opens taxing for other reason. I abhor a slight of hand from those elected to serve our collective needs.

Even with electric's we are not going to meet the global temp goals. I live in a state that has gone "all in" on renewables but still we use fossil fuel for a portion of our electric power. Going to a mileage tax will not change that fact. Neither will mandates that can't be met.

I all the proposals for a "new form of road tax" the proposals all point to the present tax is not meeting the need. They don't show how their new form will not be subject to the same problem, that is the lack of will to tax at a rate that will meet the need. SO, I question why?

MikeinPA

Well-known member

I freely admit that after a week of thinking about this, my perspective has evolved.

One strike against the current fuel tax situation is that it is established practice to raid the funds by the state and federal bureaucrats. Another is that its tacked onto billions of essential purchases (filling up vehicles) and doesn't look like much for each purchase to the taxpayer, but adds up on a yearly basis--this is a real tax but nowhere near as visible as some other taxes. A third strike is that there is still all these problems with the roads. To summarize, the taxpayer is making significant contributions to a fund that get's raided constantly and doesn't get the job done. Broken. It seems to me that your approach is more of the same, only put the meter into the EV electronics? The appeal of a new approach is that we can all agree the taxes collected go to the roads, and are scaled to provide an adequate level of maintenance. We can also jump start the conversation about what we want our country's transportation network to look like in 50 years, and in 100 years.

BTW, no state has gone all in on renewables. Not even close.

One strike against the current fuel tax situation is that it is established practice to raid the funds by the state and federal bureaucrats. Another is that its tacked onto billions of essential purchases (filling up vehicles) and doesn't look like much for each purchase to the taxpayer, but adds up on a yearly basis--this is a real tax but nowhere near as visible as some other taxes. A third strike is that there is still all these problems with the roads. To summarize, the taxpayer is making significant contributions to a fund that get's raided constantly and doesn't get the job done. Broken. It seems to me that your approach is more of the same, only put the meter into the EV electronics? The appeal of a new approach is that we can all agree the taxes collected go to the roads, and are scaled to provide an adequate level of maintenance. We can also jump start the conversation about what we want our country's transportation network to look like in 50 years, and in 100 years.

BTW, no state has gone all in on renewables. Not even close.

I don't see changing the method of collection changing any of those issues. Method doesn't change raiding, Method doesn't change that users pay a tax to drive the roads (as it should be). Some proposed methods make it harder for the poor pay.

If you want to use tax to control or adjust peoples actions, be up front that is what your goal is and expect that most will oppose that. Don't lie and say it is "fairer" or you will not use location and time data for time and use, then turn around and do so. I don't trust that the data will not be used that way, best way to be sure it isn't, is not to give up the info in the 1st place.

If you want to use tax to control or adjust peoples actions, be up front that is what your goal is and expect that most will oppose that. Don't lie and say it is "fairer" or you will not use location and time data for time and use, then turn around and do so. I don't trust that the data will not be used that way, best way to be sure it isn't, is not to give up the info in the 1st place.

m4ch1n4t10n5

New member

- Joined

- Sep 14, 2021

- Messages

- 1

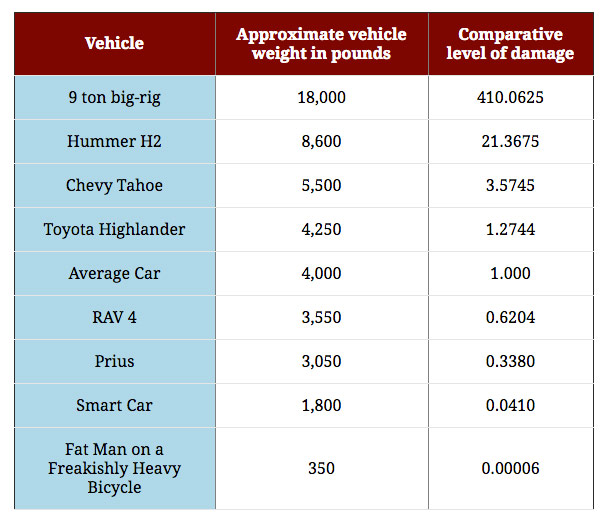

Personally I think they should just do away with the tax on gas and charge everyone the same registration fee with a weight modifier (i.e. the heavier the car the higher the fee). At least then it would be fair.

Virginia does have a "Highway Use Fee", but they are introducing a program to track your miles.

https://www.dmv.virginia.gov/vehicles/taxes-fees/highway-use

https://www.dmv.virginia.gov/vehicles/taxes-fees/mileage-choice

I will probably enroll my Leaf in this the next time I renew.

Virginia does have a "Highway Use Fee", but they are introducing a program to track your miles.

https://www.dmv.virginia.gov/vehicles/taxes-fees/highway-use

https://www.dmv.virginia.gov/vehicles/taxes-fees/mileage-choice

I will probably enroll my Leaf in this the next time I renew.

BillAinCT

Well-known member

I have a "fun" car that I drive less than 300 miles a year. That doesn't sound fair to me at all.Personally I think they should just do away with the tax on gas and charge everyone the same registration fee with a weight modifier (i.e. the heavier the car the higher the fee). At least then it would be fair.

That'd be a start but "fair" is relative. As pointed out, what about those who drive few miles a year or lots of miles a year? What about environmental impact of the vehicle?Personally I think they should just do away with the tax on gas and charge everyone the same registration fee with a weight modifier (i.e. the heavier the car the higher the fee). At least then it would be fair.

BillAinCT

Well-known member

Umm yeah since my fun car is a 1960 Thunderbird and needing lead added to the gas. That's why I don't drive it a lot. Just enough for people to see it or get ice cream.What about environmental impact of the vehicle?

MikeinPA

Well-known member

Not hard at all for me. I went every where by bicycle and well do I remember holding my breath behind buses and cars with smoke coming out of their exhaust. Just terrible.Umm yeah since my fun car is a 1960 Thunderbird and needing lead added to the gas. That's why I don't drive it a lot. Just enough for people to see it or get ice cream.It's hard to remember or imagine what the air must have been like in the 60' and 70's.

MikeinPA

Well-known member

Yes, there should be some kind of weight modifier:Personally I think they should just do away with the tax on gas and charge everyone the same registration fee with a weight modifier (i.e. the heavier the car the higher the fee). At least then it would be fair.

Virginia does have a "Highway Use Fee", but they are introducing a program to track your miles.

https://www.dmv.virginia.gov/vehicles/taxes-fees/highway-use

https://www.dmv.virginia.gov/vehicles/taxes-fees/mileage-choice

I will probably enroll my Leaf in this the next time I renew.

Chad E. Mo

Zero Credibility

...It's hard to remember or imagine what the air must have been like in the 60' and 70's.

Not really, drive behind a 1960 Thunderbird, or any newer ICE vehicle that has its cat removed.

I'm equally guilty.. my other car is a 1986 turbodiesel.

bruceha2000

Well-known member

- Joined

- Jul 8, 2010

- Messages

- 62

I'm old but not so old that I don't remember growing up in the 60's and 70's before the Clean Air Act. Grew up just south of Los Angeles. Many days we couldn't go out for recess when I was in elementary school in the 60's. Walking the mile to Junior and Senior high. Moving into the 3rd floor dorm in the early 70's meant a 20 minute "rest stop" in the room after each trip up so our lungs would stop burning.It's hard to remember or imagine what the air must have been like in the 60' and 70's.

As to the thread topic, I drive my Prius Prime maybe 4K miles a year, my wife drives her Leaf about 21K a year. Her prior car was a 2006 Prius averaging 40+ MPG in the winter, 50+ in the summer, full tank. Figure 450 gallons of gas a year.

Guess which one of us is retired

A flat $200 tax on my car would be $0.05/mile, more than doubling the current cost/mile. The same $200 on the Leaf would be $0.01/mile

Similar threads

- Replies

- 5

- Views

- 670

- Replies

- 0

- Views

- 184

- Replies

- 0

- Views

- 736

Latest posts

-

what's the oldest LEAF to buy for latest battery tech?

- Latest: deathplaybanjo

-

-

Can’ put in drive,reverse or neutral my Nissan leaf 2018

- Latest: alin nistor

-

-

-

-