I hope this will be my last post on the subject, as I think it has been well hashed out.

I am not so concerned about where I drive but that is an issue, It would be possible to learn a lot from when and where you go, Political party/political leanings, position on issues (go to a pro choice rally/ gun show etc) and it wouldn't be hard to pull that data from your movements.

The way our system is set up, people can "voice their opinion" at the ballot box, but if GPS is used, you can be taxed, not even knowing what the tax is, and have no say.

Chicago and other muni's had a tax sticker you had to pay for once a year and affix to your windshield. It was a cumbersome tax to enforce as it required sweeps to see where the vehicle was registered and cite untaxed vehicles that were registered somewhere a window sticker was required. If you were registered outside of Chicago you were ok, but inside you had to have the sticker. That is ok because you could voice your opinion to your elected official.

GPS opens time a place taxation that the taxed have no voice in. We already see that in "toll commuter lanes" where they are active at one time of day and not others. That is ok, as you can decide to use them or not. GPS would open that to all roads, for all people without giving them a say at the ballot box over the issue or rate.

Tolls are a form of taxation for all that use the toll road, regardless of where they live. GPS data allows for "tolling" everywhere, at variable rate, without the taxed having input if they live outside the area.

I can choose to take a toll road and pay the toll or take other roads and just pay the fuel tax. With GPS that goes away.

If you read the linked info, this is exactly one of the points the writers are pushing.

While it is true, if as an Iowian, I drive in Illinois I have no say on their fuel tax, but I do know what it is, and I do know that when I buy fuel it is paid, it doesn't matter when I drive, it doesn't matter if I drive through Chicago to get to Indiana, the fuel tax is the same and covers my duty to Illinois. But if GPS is used, I can be taxed at a higher rate for the time of day and the fact I drove in greater Chicago to get beyond. I have no say and with variable rate, no idea what I am taxed at just the moneys will be "deducted' from my pre-paid account.

That is the real fear I have of a GPS system of taxation. I don't fear that my info will be sold, I don't even fear (may be I should) that my interests and political positions will be known. I do fear wildly fluctuating taxes that I have no say in or no way to keep track of being imposed. It would be open to "locals" paying less and "out of area" users paying more, locals wouldn't object at the ballot box and out of area have no say.

If you don't think this is possible or an issue, as someone who ran a trucking company decades ago, states had all kinds of tax structures to tax trucks from out of jurisdiction more. It took the "commerce clause" in the constitution and

the Supreme Court to end the practice, but the' commerce clause doesn't apply to individuals (at least that is how I understand it).

We already have taxes that are aimed at "out of towners" that locals are unlikely to have to pay. Hotel/Motel taxes for example. These are legal as they tax anyone renting a room, although it will be most likely those from out of town that do so. I am not for adding road use taxes to that. With a few computer key strokes, where and when can be tailored to do the same. It WILL be promoted as a "way to reduce congestion' with out addressing the root cause of it. Those who don't know or can't adjust (people traveling through) will pay the highest rates.

In short it goes from taxing to maintain the roads, to taxing as form of movement control. Afterall, the wear, I as a single vehicle, place on the road, doesn't vary with where that road is or what time I am on it.

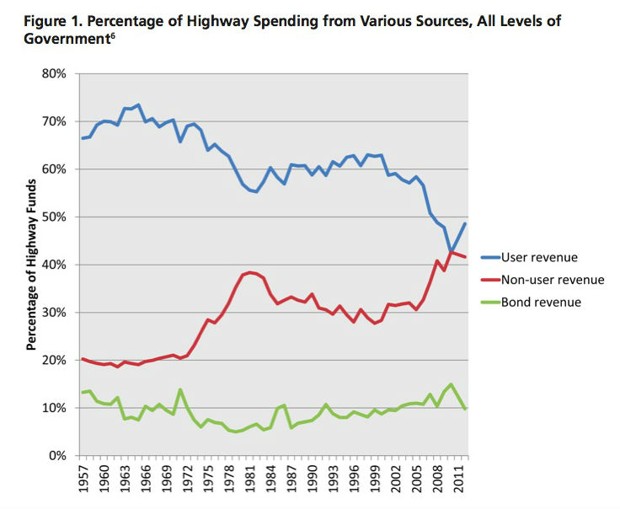

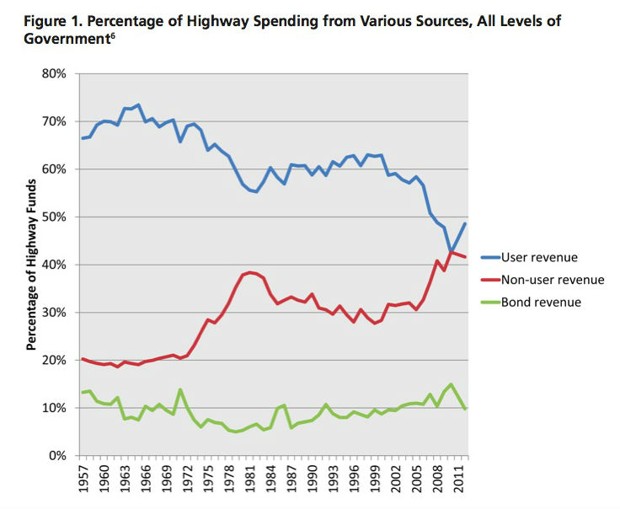

Basically going from a tax for road maintenance to a "movement" tax that is used to control where and when you move and revenue used for other things. we already have fuel tax used to fund commuter rail and bike paths, while worthwhile causes, not part of maintaining roads. I think this is a good part of the reason the graph at the top of this page shows a drop in fuel tax funding road, it is being diverted to other projects.