Newporttom

Well-known member

I'm probably the most underwater Leaf owner on the planet. In Dec 2011 I bought an 2012 SL. I rolled all the costs into the loan so I paid nothing at closing, and because I had pulled a bunch of money out of IRA's to purchase 2 rental properties, the $7500 tax credit simply reduced my tax bill to $0 and not my car loan.

So after all was said and done I had a loan that started at $41,000 with payments of $742 a month.

This month will mark the 2 year point on the loan and on the 15th the balance will be around $24,750. I figure the car is worth $15,000 or so these days. I'm trying to decide if it would be smart to bite the bullet, make a $10,000 payment on the car, and lease a new one.

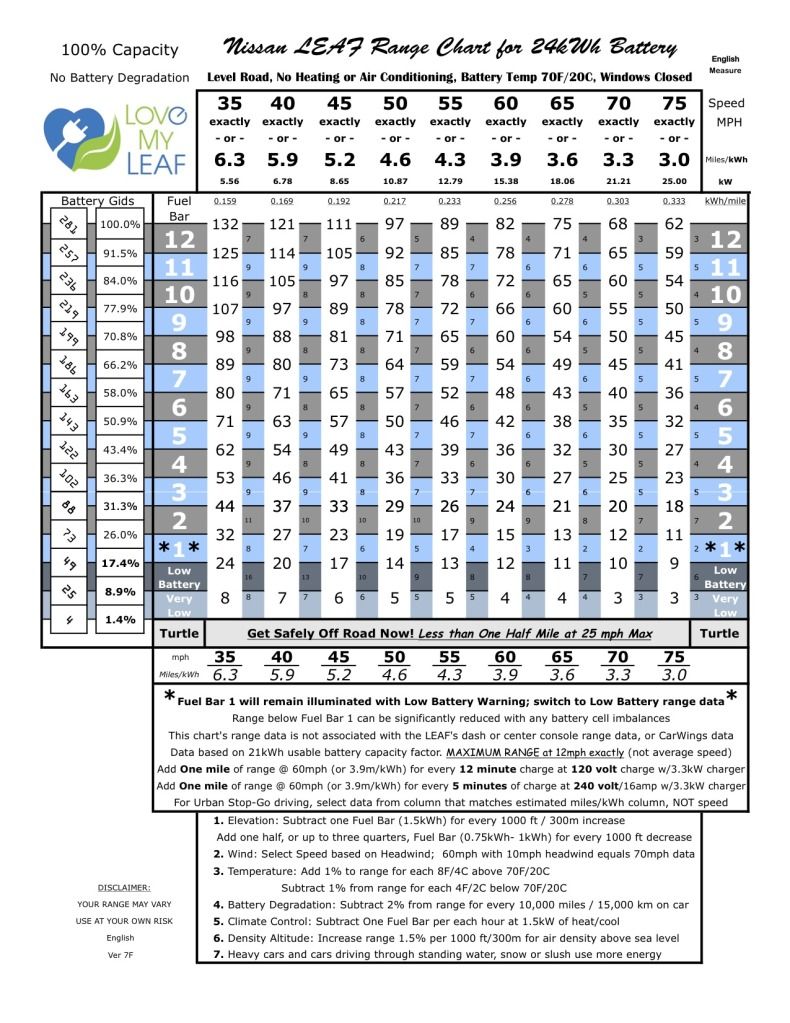

I'm in Florida, car has 28,000 miles and I've lost one bar about 6 months ago. It seems as if the range has gone down even since the lost bar. The biggest trip we really do is to go downtown for ballgames about 30 times a year and I'm starting to wonder if I can make that trip anymore. I generally would drive 60 MPH on the highway portion and get home with 15 miles or so left. Any less and my comfort level gets a little low. With the battery issues, I've regretted being an owner versus a leaser. Battery replacement program doesn't help me much. I need close to full capacity.

I'm thinking if I bite the bullet, I become a leaser and not an owner, I get a car with new batteries so I don't have to worry about range again for a while, and I get a car with a 6.6 charger allowing me to charge faster for that second trip of the day. I would probably get the SL since I really like cruise control. And depending on the lease I get, it would be nice to chop $300-400 off the monthly expenses.

Seems to me if I get a $400 lease for 36 months I essentially spend the same amount as I owe, so anything better in terms of monthly payment or length of contract saves me money over the long haul. (Except on the purchase I would have a 5 year old car free and clear). And it give me a new car in the meantime.

I'm certainly thinking about starting fresh and then in 2 or 3 years see where the EV market is.

What's the consensus?

So after all was said and done I had a loan that started at $41,000 with payments of $742 a month.

This month will mark the 2 year point on the loan and on the 15th the balance will be around $24,750. I figure the car is worth $15,000 or so these days. I'm trying to decide if it would be smart to bite the bullet, make a $10,000 payment on the car, and lease a new one.

I'm in Florida, car has 28,000 miles and I've lost one bar about 6 months ago. It seems as if the range has gone down even since the lost bar. The biggest trip we really do is to go downtown for ballgames about 30 times a year and I'm starting to wonder if I can make that trip anymore. I generally would drive 60 MPH on the highway portion and get home with 15 miles or so left. Any less and my comfort level gets a little low. With the battery issues, I've regretted being an owner versus a leaser. Battery replacement program doesn't help me much. I need close to full capacity.

I'm thinking if I bite the bullet, I become a leaser and not an owner, I get a car with new batteries so I don't have to worry about range again for a while, and I get a car with a 6.6 charger allowing me to charge faster for that second trip of the day. I would probably get the SL since I really like cruise control. And depending on the lease I get, it would be nice to chop $300-400 off the monthly expenses.

Seems to me if I get a $400 lease for 36 months I essentially spend the same amount as I owe, so anything better in terms of monthly payment or length of contract saves me money over the long haul. (Except on the purchase I would have a 5 year old car free and clear). And it give me a new car in the meantime.

I'm certainly thinking about starting fresh and then in 2 or 3 years see where the EV market is.

What's the consensus?